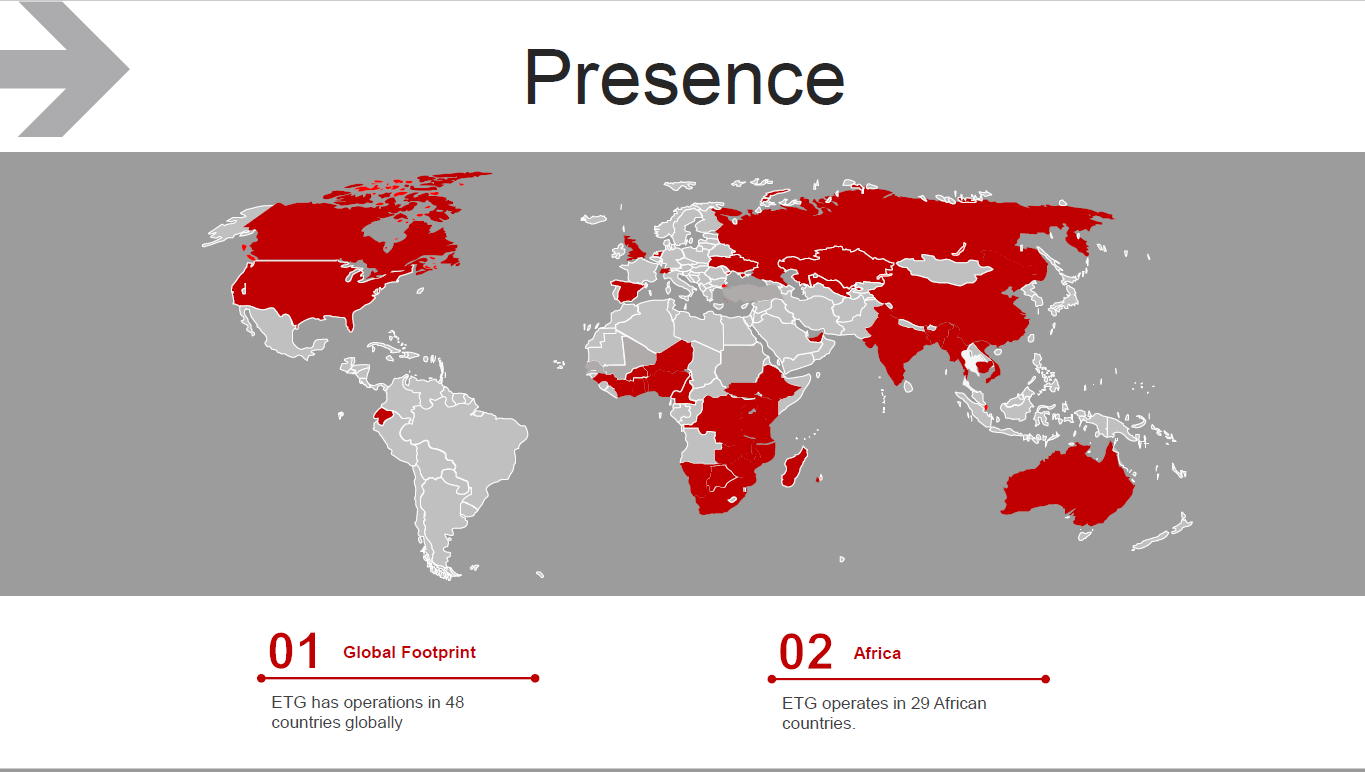

The annual China Peanut Conference hosted by CNPEANUT.COM was successfully held in Jimo, Qingdao, on July 8, 2023. At the conference, experts from various fields, such as processors, import and export traders, and commodity futures analysts, made an in-depth analysis of the supply and demand situation in the domestic and international peanut markets and the macroeconomic situation. Ms. Li Xiue, Commercial Director of ETG Group Qingdao Branch, was also invited to share her views on peanut processing and the trade situation in Africa.

Addressable market of African Peanuts

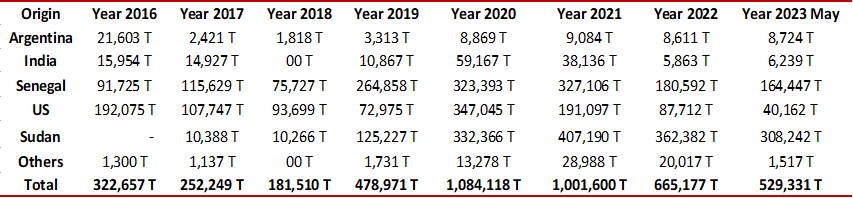

Sudan Origin

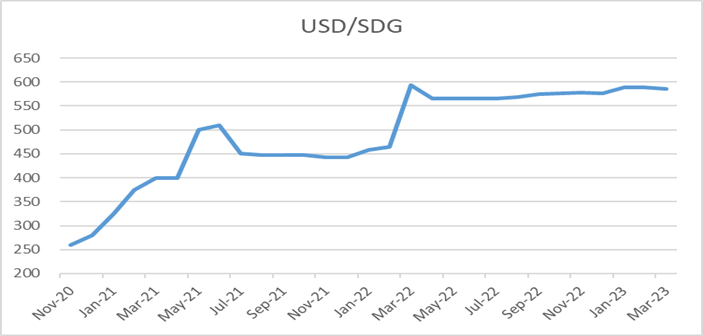

The yearly production of Sudan peanuts is around 2.5 million tons, and since China opened Sudan peanut imports in June 2019, China's annual imports have been maintained between 300k-400k tons, mainly benefiting from the excellent quality of Sudan peanuts, which are favored by domestic crushers, food factories, etc. Since 2022, Sudan peanut prices have been running at a high level, mainly due to the high international prices of other vegetable oils and fats, the increase in the crushing volume of Sudan domestic market, and the small fluctuation of the U.S. dollar against Sudan pounds, which is not favorable to exporters taking advantage of the depreciation of the currency to hedge against the high bank loan interest (16-25%) to reduce the cost of carrying goods.

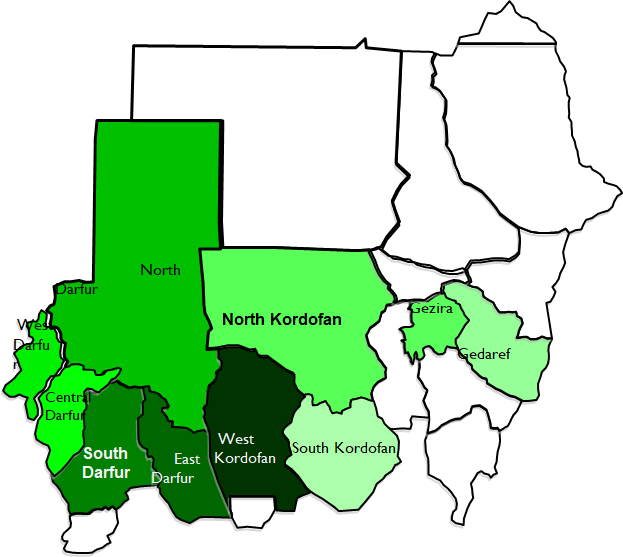

Sudan Peanuts Main Origins

US Dollar vs Sudan Pound

Since the outbreak of conflict in Sudan on April 15, 2023, around 2.5 million people have lost their homes and been displaced, including 1.3 million people in Khartoum region and more than 600k people in Darfur. Around 520k people have crossed the borders, went into exile in neighboring countries. The main peanut-producing region of Darfur may receive a large impact, and we will continue to pay attention to the new season planting situation in the following July. Another area where conflict has been concentrated is the capital of Sudan, Khartoum, where most agricultural products, including peanuts, are stored and traded, so exporters will also face tough challenges when the new season hits the market.

Senegal

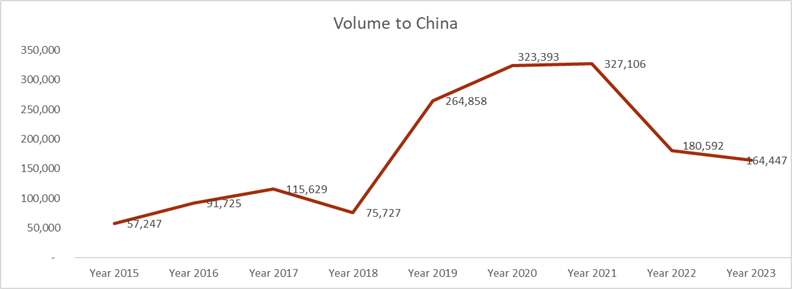

Senegal's yearly peanut production is around 1.7 million tons, of which roughly 15-30% is exported, among those exported that more than 95% is exported to China. In 2022 and 2023, Senegal's peanut arrivals decreased from previous 300k tons to around 180k tons, mainly due to the significant increase in purchases by the local domestic crushers (purchases increased by 60%).

Senegal Peanuts Volume to China

African Peanuts Export Outlook

Three things need attention: 1. Weather conditions in July-September; 2. International agricultural inputs (fertilizer/pesticide) prices; 3. Government stability.

Notes: These statements made and forward-looking views expressed in this presentation are merely for analysis of the market. These are not trading recommendations.